This investigation is part of the Cyprus Confidential project initiated by ICIJ and Paper Trail Media. Over 270 journalists from several countries have worked on the project to uncover the secrets of tax havens. For eight months, they examined 3.6 million confidential documents (1.31 TB of data) that became available through leaks from offshore business service providers running straw companies in Cyprus. This investigation was prepared with the support of OCCRP and CyberPartisans.

In 2012, businessman Ternavskiy and his company Univest-M were blacklisted by the European Union because of his ties with Lukashenko. The sanctions were imposed following the 2010 presidential election in Belarus. The OSCE did not recognize them as fair, and the Council of Europe called them fraudulent.

“Ternavskiy’s dealing with oil and oil products testifies to his close relations with the regime, taking into account a state monopoly on the oil refining sector and the fact that only several individuals are entitled to operate in the oil sector,” the EU decision reads.

Ternavskiy challenged the restrictions in court and tried to avoid them. In 2014, he was taken off the sanctions list.

“The Council considers that there are no longer grounds for keeping certain persons and entities on the list of persons and entities subject to restrictive measures as set out in the Annex to Decision 2012/642/CFSP,” the EU decision reads.

Ternavskiy has continued to earn money both in Belarus and in Europe. He moved money between his companies with the help of Swiss citizen Stephan Brunner, while remaining invisible to Western regulators.

Like Abramovich

In the summer of 2012, four months after Ternavskiy was sanctioned by the EU, a new company, Medesoil Trading Limited, was established in Cyprus. It dealt in petroleum products. [*] The founder of Medesoil Trading is Finservus (Trustees) Limited, a Cypriot company. [*] The British and American press reported that the company was listed as a nominal shareholder in the businesses of Russian tycoons Konstantin Malofeyev and Roman Abramovich. It got rid of Medesoil Trading’s shares on the day the company was founded. [*] This can be explained by the fact that Finservus is owned by MeritServus, a big provider of corporate services in Cyprus that holds shares for its clients in many companies. It is likely that Finservus was the nominal owner of Medesoil Trading.

Swiss citizen Stephan Brunner became the new owner of Medesoil Trading. He was the sole proprietor of the company’s shares until 2015, when most of the shares passed to Ternavskiy’s daughter Natalia. In February 2016, she became the sole owner. [*] [*] [*]

In those years, the expenditure line “Director’s renumeration as executive” was included in Medesoil Trading’s financial statements. In 2013 and 2014, this renumeration totaled $590,000 and $623,000 respectively. [*] This line probably refers to the fee for Brunner, who was the nominal owner of the company at the time.

“The regulated professionals involved here, the lawyers, the accountants, and the company formation agents should be carrying out enhanced due diligence on these companies to make sure sanctions weren’t being avoided at the time. There appears to be a conflict of interest here where a person is being paid to act as possibly a nominee director,” Ben Cowdock, head of investigations at Transparency International UK, suggested in a conversation with the BIC.

The conflict of interest may be that Brunner, in his role as an agent, should have found that Ternavskiy was subject to sanctions, and that firms in which Ternavskiy or his family members had vested interests could be used to get around these sanctions. Instead, Brunner was probably helping to hide the real owners of the companies, and making money for it.

According to Cowdock, if a trust agreement was made with Brunner to control Medesoil Trading, then someone else owns or controls the company. BIC has no information on whether such an agreement exists. But Brunner is also listed as a director in other companies linked to the Ternavskiy family.

Medesoil Trading has generated over two billions dollars in revenue from its founding in 2012 through 2021. The company’s net income for these years was about $10 million. [*] [*] [*] [*] [*] [*] [*] [*] [*]

Oil dealing on special terms

Medesoil Trading bought oil products from the national Belarusian Oil Company (BOC). Under a contract dated December 2, 2015, Medesoil Trading planned to purchase up to 100,000 tons of petroleum products, in particular unleaded petrol AI-92, from BOC. [*] [*] The value of the contract, based on oil product prices at the time of signing, can be estimated at approximately 100 million euros.

BIC discovered this information through leaked documents from the archives of offshore providers operating Cypriot companies. This contract is also notable because we were unable to locate a suitable tender for the deal on the BOC website.

Medesoil Trading simultaneously participated in national oil retailer competitions. BIC found two tender agreements between Medesoil Trading and BOC dated 2014 and 2015. [*] [*] [*] [*] [*] [*] With the assistance of the activist group CyberPartisans, we learned that Medesoil Trading also purchased oil products from the BOC in 2019 -- over 3,000 tons of fuel oil from the Mozyr Oil Refinery worth almost 1 million euros. [*] [*] That year, Medesoil Trading earned an unparalleled at least until 2021 profit of $3.9 million (an increase from $3.4 million ithe previous year). [*]

Medesoil Trading also sold petroleum products to the world’s leading traders. These included Global Energy and Trading SA, Petraco Oil Company LLP, Vitol SA and Totsa Total Oil Trading SA. [*] [*] [*] [*] [*] [*] [*]

Medesoil Trading earned $53 million in 2013. Its revenue grew to $269.6 million in 2020 and $333 million in 2021, which is the most recent year for which BIC obtained the company’s financial report.

Medesoil Trading continues to exist, with Natalia Ternavskaya as its beneficiary. She received dividends of at least $540,000 in 2020 and 2021. [*] [*] [*] [*]

We called Anatoly Ternavskiy's office, but he refused to answer our questions about the collaboration between Medesoil Trading and the Belarusian Oil Company. Instead, we were given the number of his assistant, Sergey Valerievich. According to Cyberpartisans, this number belongs to Ternavsky's company, Univest-M. Currently, it is likely being used by Sergey Kapitanov, who previously held the position of Deputy Director at Univest-M. The interviewee was aware of Medesoil Trading's activities but declined to answer questions over the phone.

Who is Ternavskiy?

Anatoly Ternavskiy was born in Kerch, a city in eastern Crimea. [*] He entered Belarusian business circles in 1998 when he became vice-president of Slavneft, originally a joint Russian-Belarusian company that bought almost half of the Mozyr Oil Refinery in Belarus. In January 2000, the company was headed by Mikhail Gutseriev, a Russian billionaire who was also vice-speaker of the State Duma of the Russian Federation.

Ternavskiy is a member of the Board of Trustees of Russia’s Holy Trinity-St Sergius Lavra, along with people from Vladimir Putin’s inner circle – Rostec Corporation CEO Sergey Chemezov, Russian Defense Minister Sergei Shoigu and First Deputy Head of the Presidential Administration Sergey Kiriyenko. In 2021, Ternavskiy was awarded the 3rd Degree Order of St. Seraphim of Sarov by the monastery.

“People do charity work... and maintain business ties there,” Ternavskiy told Forbes about Lavra in early 2016.

Ternavskiy is married and has two daughters, Anna and Natalia. The father of Natalia’s children is Tamerlan Marzoev (it is unknown if their marriage is official). He appeared in the Panama Papers as a shareholder in Haycraft Overseas Trading Ltd registered in the British Virgin Islands.

Sanctions are no obstacle

Ternavskiy and his company, Univest-M, were sanctioned by the EU in 2012. The EU named the company one of the two major private oil exporters in Belarus. Univest-M was also engaged in real estate investments. In 2006, it was the third biggest taxpayer in Belarus behind two oil refineries in Mozyr and Novopolatsk. The firm ranked in the top 10 Minsk taxpayers in 2012, despite the EU sanctions.

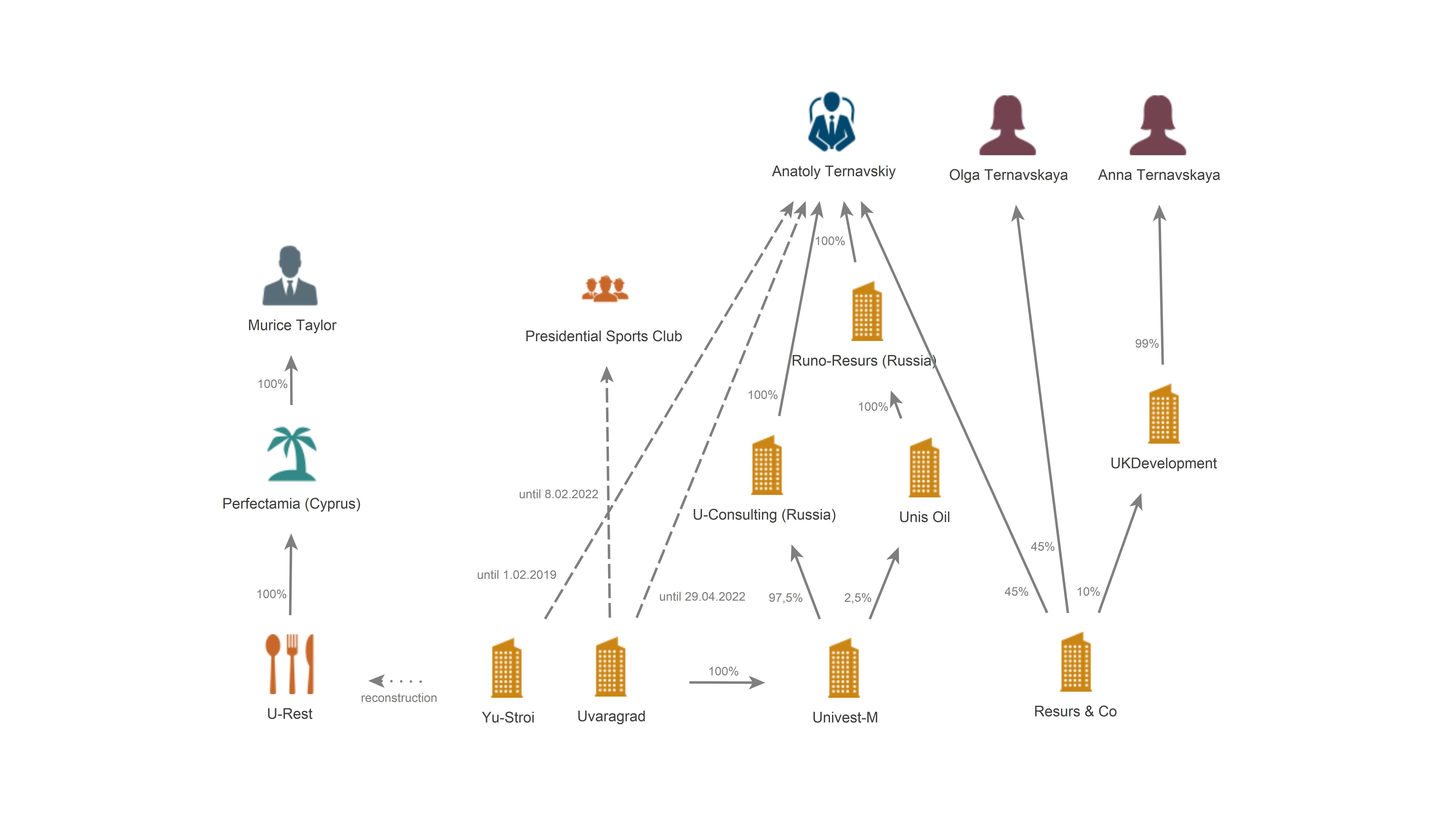

From 2008 to 2011, the position of deputy general director at Univest-M was held by Anna Lukashenko, the wife of Aleksandr Lukashenko's son Dmitry Lukashenko. [*] Univest-M was also known as a sponsor of the Presidential Sports Club (PSC), which is run by Dmitry Lukashenko. Until April 2023, the PSC website listed Univest-M among its partners.

In 2022, Univest-M’s net profit was 8.6 million rubles (about $3.3 million), and its real estate investments were 36 million rubles (about $13.7 million). [*] [*]

Ternavskiy is still a beneficiary of Univest-M. He owns the company through foreign LLC Unis Oil and Russian LLC Yu-Konsalting, which owns 97.5% of Univest-M. [*] [*] [*] [*] [*] [*] [*] [*]

The school for Nikolai Lukashenko

Until February 2019, Ternavskiy owned construction foreign LLC Yu-Stroi. [*] [*] Under his management, the firm built a private school in the Drazdy estate, established by Irina Abelskaia, who is the mother of Aleksandr Lukashenko's Nikolai Lukashenko. Ternavskiy’s longtime colleague, Russian businessman Mikhail Gutseriev, planned to invest $12 million in the project. BIC journalists called Abelskaya to ask about her relationship with Ternavskiy, but she would not talk and hung up.

According to the BIC sources, this is the school where Nikolai Lukashenko studied following his departure from the Belarusian State University Lyceum in August 2020. Three daughters of Dmitry Lukashenko and children of other officials also studied there.

Yu-Stroi was engaged in the reconstruction of the Vankovich Estate. As a result, the former artist museum became a restaurant owned by the Ternavskiy family through Perfectamia Enterprises, a Cypriot company. [*] [*] Perfectamia Enterprises took loans from Medesoil Trading when Ternavskiy was under EU sanctions in 2013. [*]

In 2016, the restaurant Usadba began to cater for officials and law enforcers. It has repeatedly provided catering services to the State Customs Committee, the Investigative Committee, the Main Department of the Commander of the Interior Troops of the Home Ministry, the State Control Committee and the Department for the Execution of Punishments. [*] [*] [*] [*] [*] [*] [*] [*] [*] [*] [*] [*] [*] In 2022, the business generated 227,000 Belarusian rubles net profit. [*] Perfectamia Enterprises owned the Minsk restaurants Bella Rosa until July 2021 and Limoncello until August 2017. [*] [*] [*] [*]

In fair property

Yu-Stroi was involved in the Cascade project in the center of Minsk, which includes residential buildings, a business center and social facilities. The Cascade developer was Ternavskiy’s company, Univest-M. Commercial and office space in the Cascade and Cascade-Alpha structures are available to rent from LLC Resurs & Co and LLC Unis Oil. Ternavskiy and his family are beneficiaries of these entities. [*] [*]

A representative of Resurs & Co confirmed in a telephone conversation with a BIC reporter that the company is the owner of these properties: “Yes, we are not an agent, we own it. Buildings in both Hikala and Kalvaryjskaya streets are our property. We let our own premises.”

At the time of writing, Resurs & Co is the sole company in Belarus that Ternavskiy owns directly. He and his wife Volha each own 45 percent. Hanna Melkanyan is in charge of Resurs & Co. She was a director at Unis Oil from 2016 to 2019. [*] [*]

The remaining 10% of Resurs & Co is owned by LLC UKDevelopment. Its beneficiary is second daughter, Anna Ternavskaya. [*] [*]

UKDevelopment is also the owner of the business center Cascade Alpha. The company’s revenue in 2022 amounted to 2 million Belarusian rubles (about $700,000). [*]

The credit carousel

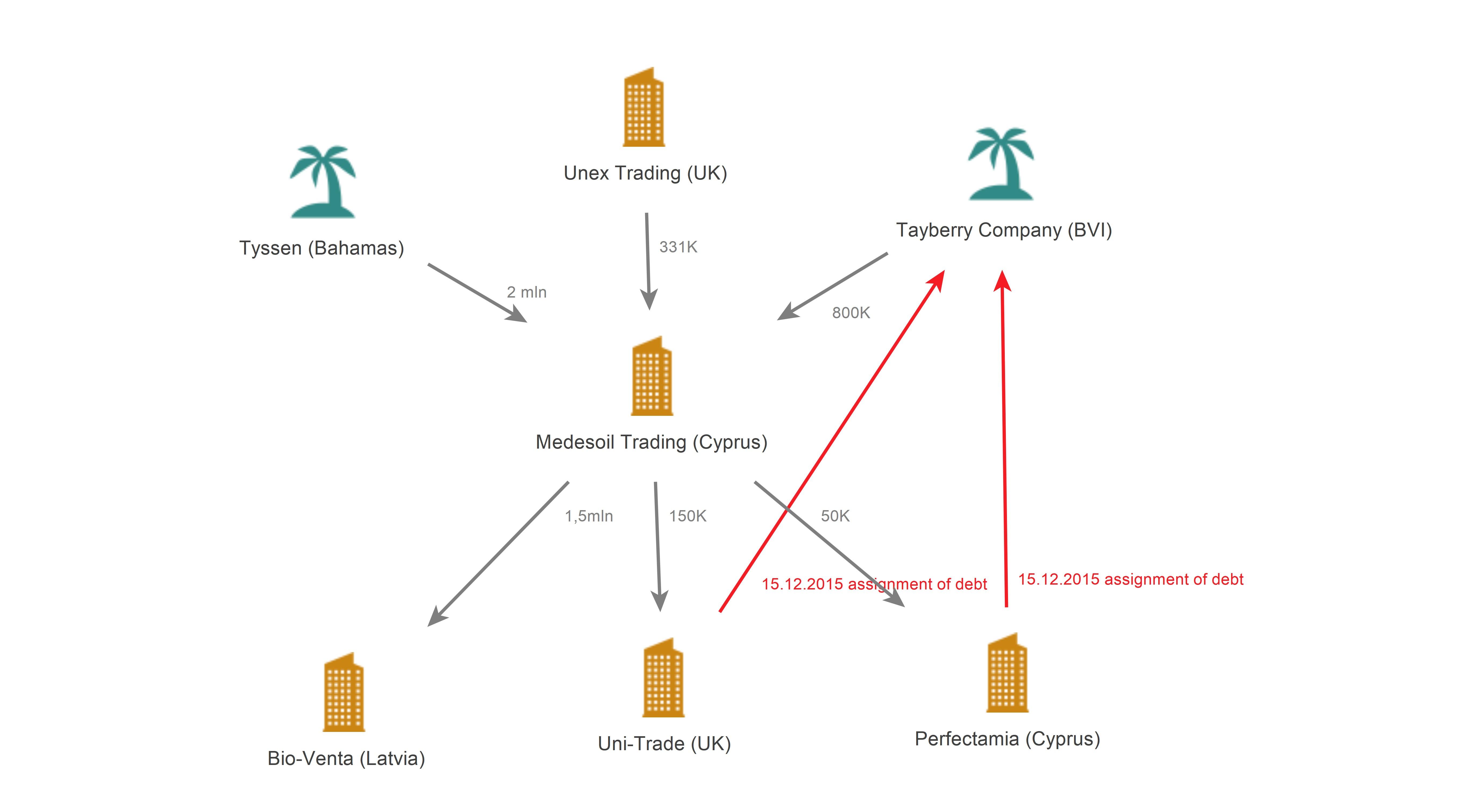

We have loan agreements in our possession from the Cyprus Confidential project, indicating a credit carousel. It involved Cyprus-based Medesoil Trading and other Ternavskiy family companies.

In 2013 and 2014, Medesoil Trading got loans worth over $3 million from Tyssen Corp. based in the Bahamas, Tayberry Company Management Ltd based in the Virgin Islands, and Unex Trading Ltd based in Britain. [*] [*] [*] [*] [*]

During the same two years, Medesoil Trading provided loans to Perfectamia Enterprises in Cyprus, Uni-Trade Ltd in Britain, and SIA Bio-Venta in Latvia. [*] [*] [*] [*] [*] [*] [*] [*] One year after Ternavskiy’s sanctions were lifted, in December 2015, the rights to claim the debt from Uni-Trade and Perfectamia Enterprises were transferred from Medesoil Trading to Tayberry Company Management in the Virgin Islands. [*] [*] [*] [*] [*] [*] We were able to establish that the Ternavskiys ran at least three companies from this credit carousel apart from Medesoil Trading -- Perfectamia Enterprises, Uni-Trade Ltd and Unex Trading Ltd.

We have information from Medesoil Trading’s financial records that shows it is linked with Perfectamia Enterprises. [*]

As of October 2023, Maurice Taylor owns shares in Perfectema Enterprises. He was previously a director of Medesoil Trading and other Ternavskiy companies. [*] [*] [*] [*]

In 2016 he also took over as head of Medesoil Trading’s Swiss subsidiary. [*]

The Ternavskiy family were the ones who benefitted from Uni-Trade Ltd and Unex Trading Ltd, both British companies, participating in the credit carousel scheme. Natalia Ternavskaya owned 75% or more of Unex Trading Ltd as of 2016 and the same amount of shares at Uni-Trade Ltd in 2016 and 2017. [*] [*] [*] [*]

According to Cowdock, head of investigations at Transparency International UK, this scheme to transfer money through jurisdictions that have imposed sanctions on Ternavskiy looks like a classic case of avoiding restrictions.

“There are a lot of risk factors in this scheme of money movement. One of those is the use of companies in different jurisdictions with linkages to a sanctioned person. So whether it’s owned by the sanctioned person’s daughter, or by a person who’s previously provided services for a sanctioned person, that definitely raises suspicions that there could be some way of looking to avoid sanctions here,” Cowdock told BIC.

Cowdick said such a scheme facilitates moving money between related companies and financing their activities. In this way it is possible to circumvent sanctions because the name of the sanctioned individual is not on the company’s papers, he explained.

Secret Belarusian assets

According to records from the Cyprus Confidential project, it appears that Ternavskiy was involved with a firm that owns investment properties in Belarus worth 4.4 million Belarusian rubles (about $1.6 million).

We have seen correspondence between lawyers who refer to Cypriot Steeleron Investments Limited and two companies in the British Virgin Islands, Caplan and Tibbet, as Ternavskiy’s companies. In October 2011, lawyer Peter Vaske sent an email to Meritservus, a Cypriot business services provider, stating that the firm had opened three companies “for them”. Vaske also calls Ternavskiy his partner and Meritservus’s client. He also states that Ternavskiy’s companies “have a necessity for carrying out of calculations among themselves under mutual obligations.” The lawyer asks for a deal: “Tibbet sells to Ternavsky Anatoly's company 100 % of shares of company Steeleron”. [*] [*]

The deal was valued at $3.3 million. Steeleron Investments has been operating at a loss since its founding in November 2010. [*] [*] [*] [*]

The agreement demonstrates that “Ternavskiy’s company” was called Arco Trading Ltd, and it purchased the shares of Steeleron Investments. The agreement with Arco Trading was ratified by Brunner, the Swiss citizen involved in the other sanctions avoidance schemes. He served as a director of Steeleron Investments. [*] [*]

Arco Trading appeared in a previous BIC investigation in cooperation with OCCRP. Arco Trading is the owner of the Panamanian firm Santarina Management S.A. It loaned $68.5 million to Natalia Ternavskaya’s firm Unex Trading.

There are additional indications of connections between the Ternavskiys and Steeleron Investments. Meritservus employees sent invoices for the company’s services to Ternavskiy. [*] [*] [*] [*] The lawyer Vaske informed Meritservus in November 2011 that further work on Steeleron should be carried out with Ternavskiy’s representative, Natalia Ternavskaya, “as she is a shareholder and beneficiary of the company.” [*]

BIC also discovered another company that may have had ties to the Ternavskiys. In 2011, Cyprus-based Mainship Limited and Steeleron Investments agreed that the former would transfer to the latter the right to claim the debt from Mainship Realty, a company registered in Belarus. The amount of the debt was 500,000 euro. [*] Six months later, the companies cancelled that agreement. [*]

Based on analysis of Mainship Realty documents, it would appear that between 2011 and 2013, the Ternavskiy family were the beneficiaries, because the owner of the company during that time was their lawyer Vaske. [*] [*]

In 2022, Mainship Realty had 4.4 million Belarusian rubles (about $1.6 million) in investment real estate assets. [*]

The grey beneficiary

The scheme described in this story was used by Ternavskiy before. In April 2012, it appears he retrospectively withdrew as a shareholder of Roping Marketing Corp. in the British Virgin Islands to avoid European sanctions. His shares were then transferred to a Panamanian firm Pemlock Finance Corp. The ultimate beneficiaries of these shares were Steval Management employees, a Swiss company that managed Ternavskiy’s assets.

Roping Marketing Corp. owned a 75% stake in Uni-Trade Limited, a UK-based oil and petroleum products wholesaler. [*] [*]

While Ternavskiy was under sanctions, Uni-Trade Limited continued to do business, reporting profits of up to $500,000 per year. [*] [*]

The beneficiary of Roping Marketing Corp. and its British subsidiary Uni-Trade was Ternavskiy’s daughter Natalia. The Swiss citizen Brunner, owner of Steval Management, was listed alongside the main Uni-Trade’s shareholders – Roping Marketing Corp. This is the same Brunner who was the owner of Cyprus-based Medesoil Trading until Ternavskiy was cleared of sanctions. [*]

Brunner also managed Ternavskiy daughter’s British company, Unex Trading Limited, until 2016. Two investigations by BIC found that Brunner assisted the Ternavskiy family in carrying out business in Europe for a prolonged period despite the sanctions.

BIC sent inquiries to Anatoly and Natalia Ternavskiy, Maurice Taylor, Stephan Brunner, the European Council, Belarusian Oil Company, Mainship Realty, Resurs & Co., Unis Oil, Yu-Stroi, Univest-M, UKDevelopment, U-Rest, Meritservus, and Bio-Venta. We have received no replies.

Our colleagues at the International Consortium of Investigative Journalists (ICIJ) have produced an interactive graphic representation of six financial services providers in Cyprus whose leaked documents formed the basis of the investigation. One of them is MeritServus, which offered corporate support services to the subjects of our article: