- In March 2022, the European Union banned imports of some Belarusian wood (articles of wood and wood charcoals under code 44). Once the sanctions came into effect, wood exports from Kazakhstan to the EU increased by 74 times; an upswing of almost 18,000 times was observed for Kyrgyzstan.

- Kyrgyz companies with Belarusian trail unreservedly offer to supply sub-sanctioned products directly to the EU using forged documents. Belarusian Investigative Centre (BIC) learned about three such companies. One of them plans to bring “trainloads” of pellets to Europe.

- After the introduction of sanctions, BLK Trading, a wood dealer registered in Poland, continues to make direct payments to its Belarusian state-owned headquarters. All the while, the company claims to be engaged in the supply of wood from Kazakhstan.

- According to the BIC’s estimates, the indirect re-export of Belarusian wood to the EU through Kyrgyzstan and Kazakhstan brought some 30 million euros to its organisers. In part, this business is carried out by former Belarusian officials.

This material was prepared in partnership with Siena (Lithuania), Kloop (Kyrgyzstan), Vlast (Kazakhstan), Re:Baltica (Latvia), Fundacja Reporterów (Poland).

Sanctions will fly when the axe you ply

In recent years, wood has made a significant part of Belarus’ exports. Concurrently, the country’s forested area has been shrinking. According to the Global Forest Watch, Belarus’ forest cover has decreased by 11% over the past 11 years. The peak of deforestation occurred in 2016 when world oil prices fell, and Aleksandr Lukashenko began to look for other ways to replenish the country’s budget.

By 2020 Belarus had been ranked 9th among the largest suppliers of wood and wood products to the EU. In 2021, world wood prices rose, and in the spring, they reached record levels. By the end of the year, Belarus had exported $2.3 billion worth of wood and wood products.

Two-thirds of these exports were transported to the EU under customs code 44.

This includes sawn logs and boards, plywood and chipboard, wood pellets and briquettes. In the European Union, the main buyers of these Belarusian-made goods were Poland, Lithuania, Latvia, Germany, and the Netherlands.

In March 2022, the EU introduced a new package of sanctions against Minsk for supporting the Russian invasion of Ukraine. The export of products under code 44 to Europe was completely banned. Regulators gave suppliers a postponement until 4 June, to allow them to sell the volumes contracted before the sanctions were announced.

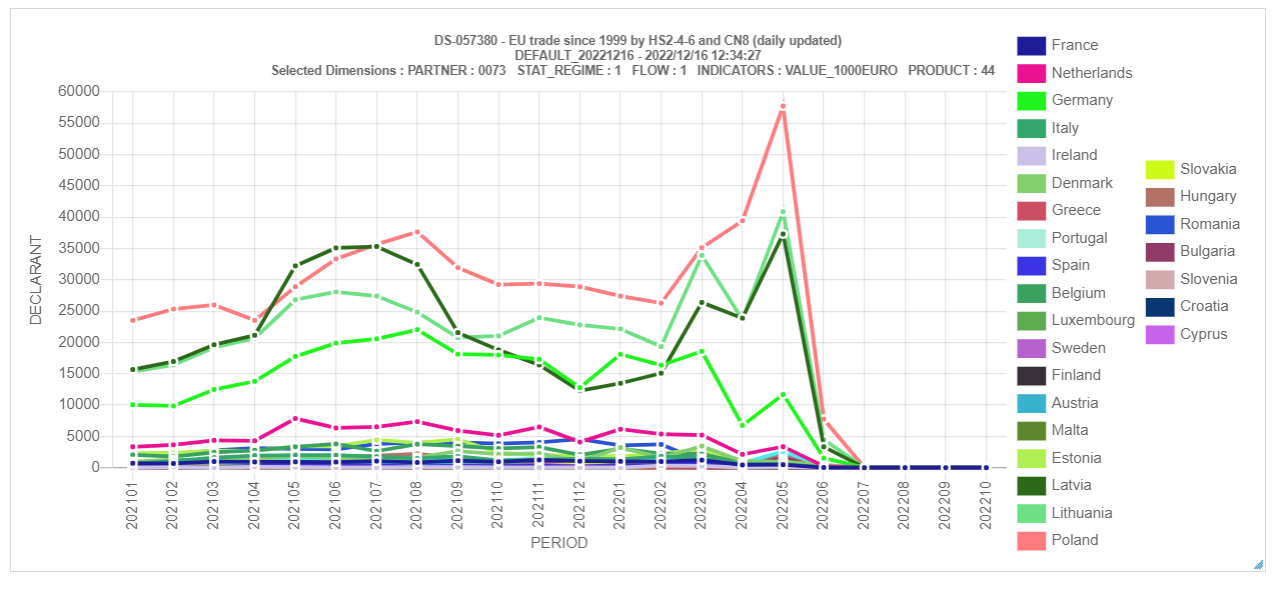

As a result, wood supplies to the EU from Belarus have dropped by more than 30 times since June 2022, according to Eurostat data.

EU imports of products with code 44 from Belarus, Eurostat data

It is impossible to correlate these with the Belarusian statistics as Belstat classified its data on exports not only to the EU but also to the CIS countries. The BIC figured out why it might be needed.

Where there's demand, there's supply

The Belarusian wood import ban has led to a shortfall in some EU countries. A week after the sanctions took effect, Lithuania’s Deputy Minister of the Environment announced an acute shortage of wood in their country. A similar situation was observed in Estonia and Poland.

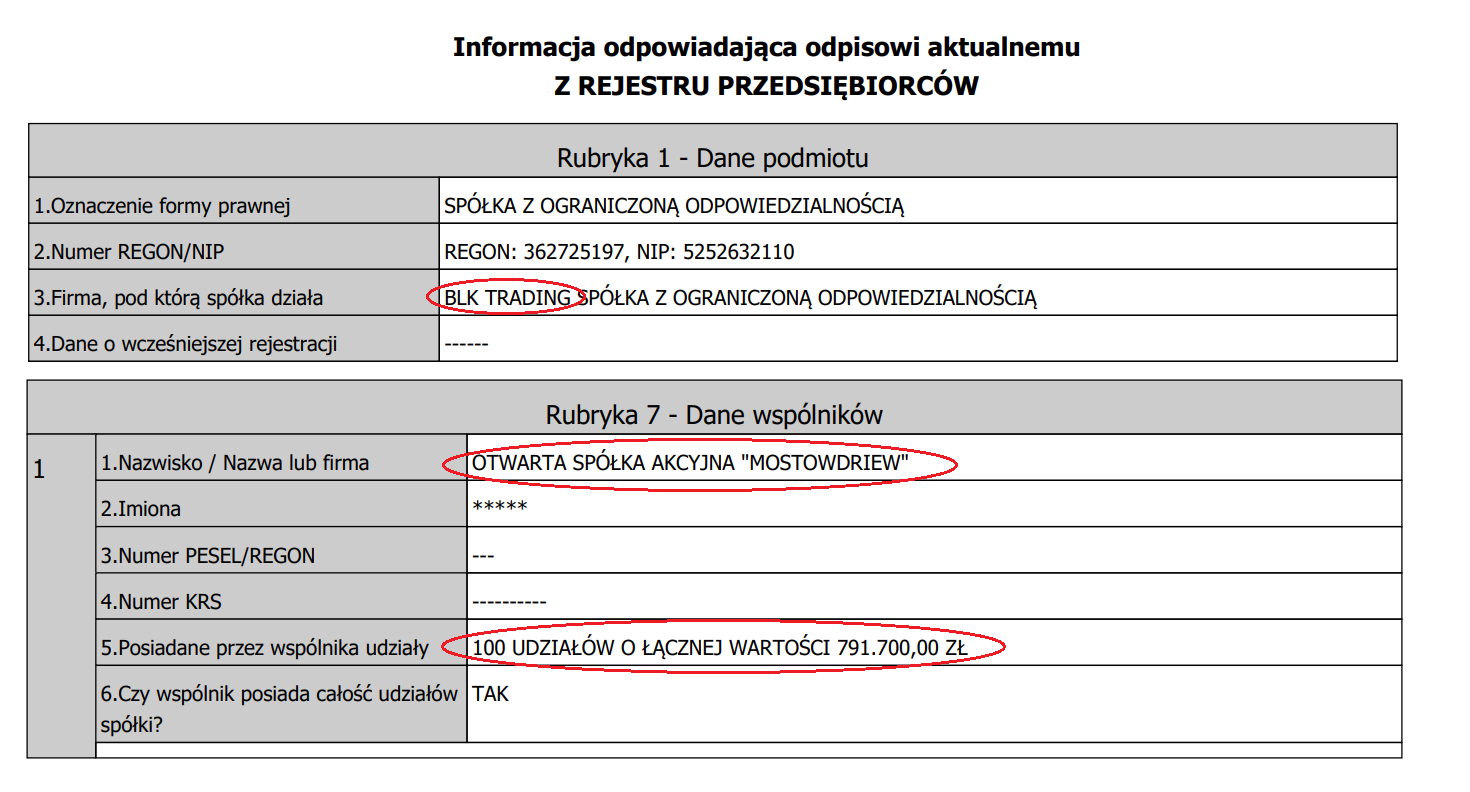

Poland used to buy some of its wood through the BLK Trading company, with BLK standing for the “Belarusian Forest Company” (Belorusskaya Lesnaya Kompaniya). It is registered in Poland as a private enterprise, but its owner is the Mostovdrev Belarusian state woodworking enterprise.

BLK used to supply the products of nine Belarusian wood manufacturers to Poland, with IKEA’s suppliers among its customers, according to one of the dealer’s employees. It is noteworthy that the company only traded products under the currently sanctioned code 44. In 2021, the volume of shipments reached approximately $34 million, but this year they should have decreased significantly, due to the sanctions. [*]

To verify this, the BIC obtained documents relating to mutual settlements between BLK and Mostovdrev in 2022. At the end of September, the trader transferred almost $17 million to its owner.

It’s only half of what it was in the whole of 2021. Mostovdrev explained to BIC that the company doesn't receive money from BLK for products that are subject to EU sanctions. However, the website of the Polish company shows that they only trade in goods under the prohibited code 44. Mostovdrev refused to answer additional questions. We sent them a request and are awaiting a response. BLK told us that the company didn’t make a single delivery or a single payment that would violate the laws.

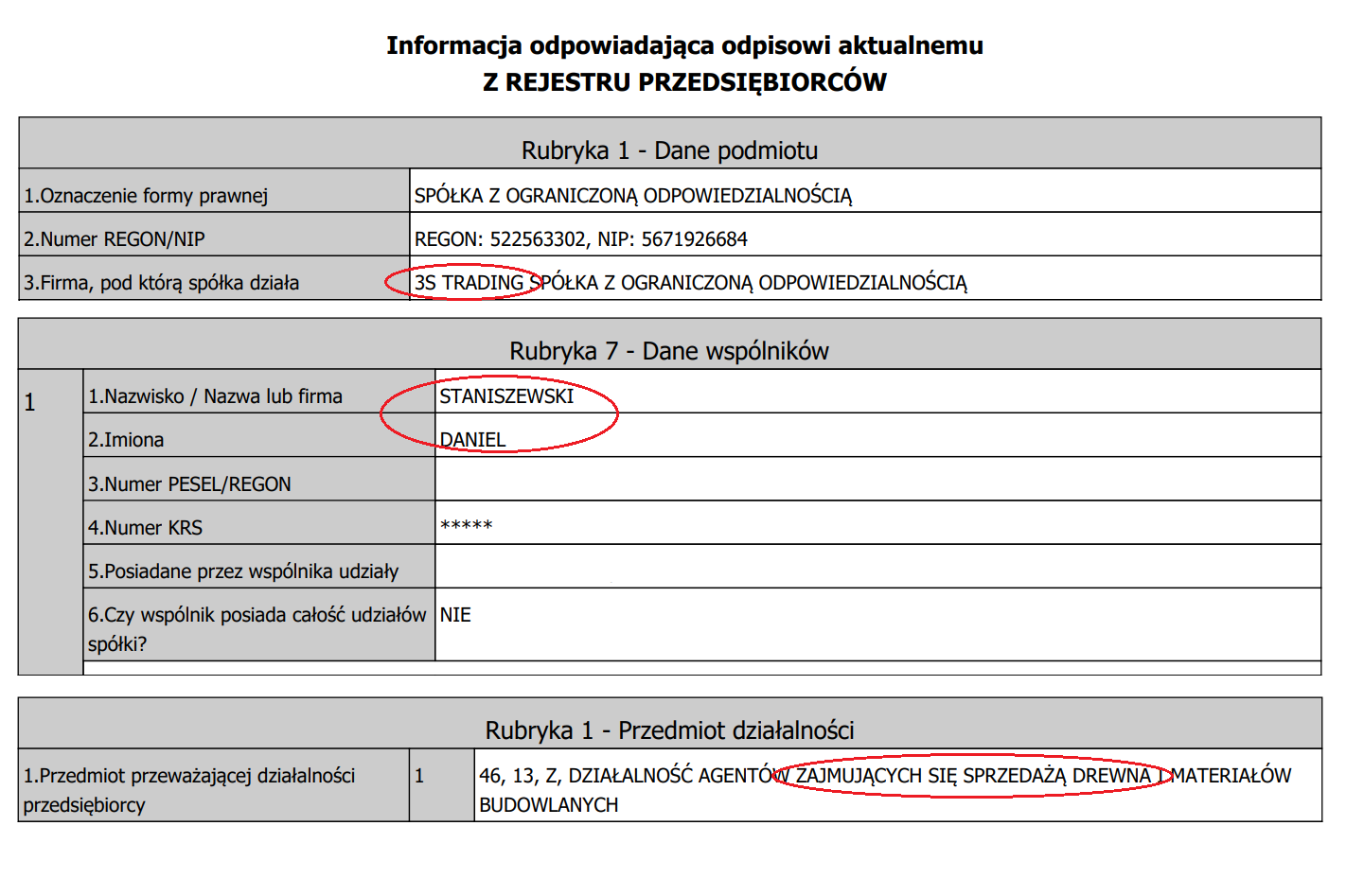

In September, the BLK Trading Sales Director for Europe created a new company in Poland – 3S Trading. The company is owned by him and his partner and is registered at the same address as BLK Trading. The company’s profile is the sale of wood and the production of wood products – just like BLK Trading’s.

Under the guise of a Polish supplier, BIC journalists called BLK Trading and tried to buy Belarusian wood products. The sales manager confirmed that the company did have wood from Belarus, but it was soon going to run out as they had been selling the remaining stock. She also noted that the firm had begun to work with new suppliers from Ukraine and Kazakhstan.

The situation is similar in Lithuania. Before the introduction of European sanctions, the country was a major buyer of Belarusian wood, and now extensively imports it from Kazakhstan and Kyrgyzstan. The share of Kazakhstan’s and Kyrgyzstan’s wooded land is 5% and 6% accordingly. For reference, the forest cover of Belarus is 40%, according to the country’s Ministry of Forestry.

Trunks in Kyrgyzstan, roots in Belarus

The BIC reviewed the Eurostat data on imports of products under CN code 44. As soon as the sanctions on Belarusian wood took force, exports to the EU increased by 74 times from Kazakhstan and by almost 18,000 times from Kyrgyzstan, relative to the same period in 2021.

In financial terms, it is more than 30 million euros for both countries.

However, the government of Kazakhstan forbade the export of some wood products last December to develop the local wood industry. The ban was extended twice – in summer and winter. The Kyrgyz authorities introduced similar measures.

BIC got the clue trail for how these countries might supply wood to Europe thanks to a mailing that reached the editorial office. The private Belarusian expert reviews centre Quality Standard offered services for the indirect re-export of goods from the EU to Belarus through Kyrgyzstan.

Under the guise of potential clients, BIC journalists talked to the company’s manager and tried to find out whether it was possible to do a reverse and re-register Belarusian wood in Kyrgyzstan for delivery to Europe.

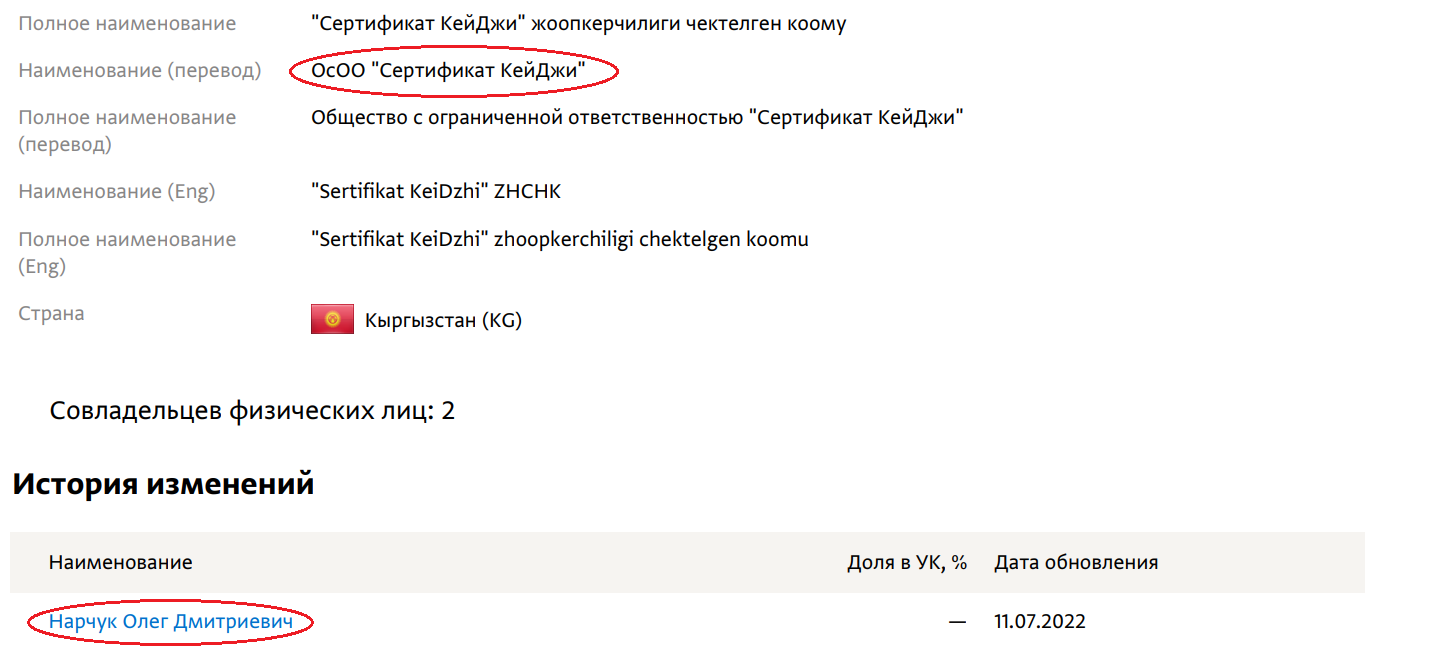

A few days later, Quality Standard offered cooperation with the Certificate KG company.

This company helps Belarusian wood product suppliers obtain Kyrgyz documents for their cargo and pass EU customs.

The BIC learned that one of the Certificate KG’s co-founders, Aleh (Oleg) Narchuk, used to work for the state standardisation committee Gosstandart.

Also, he was previously among the co-owners of the Quality Standard firm that offered services to circumvent sanctions.

This autumn Aleh Narchuk spoke at a webinar organised by the National Centre for Marketing and Price Study on “Imports of goods into the Republic of Belarus under sanctions”.

In addition to Certificate KG, Aleh Narchuk was associated with several more companies in Kyrgyzstan, namely KSK Alliance, KSK Alliance Test Centre, and KSK Trading. Narchuk denied that these firms are helping to circumvent sanctions.

A wagon filled with sanctioned products

Aleh Narchuk was not the only businessman who started establishing business relations between Belarus and Kyrgyzstan. The BIC has identified three more companies that deliver Belarusian products to Europe using sham papers – Agro KG, SK Grand and Admit company. Under the guise of a client, a BIC journalist contacted a representative of the latter company. In the conversation, the employee admitted that Agro KG used to bring pellets to Europe using trucks, but they plan to switch to wagons.

On 2 August 2022, five months after the imposition of the EU ban on Belarusian wood import, the Admit company was founded in Bishkek.

On its website, the firm – registered five months ago – claims that it receives over 40,000 tons of wood waste “yearly”.

The company is engaged in wood waste processing and produces pellets, briquettes, and other wood fuels. Under the guise of customers, the BIC journalists called Admit and asked them to help with the delivery of Belarusian pellets to Europe. The company agreed to do so in Kyrgyzstan, where they had a production facility and could send Belarusian products to Europe alongside their own produce, issuing Kyrgyz certificates for them.

Admit could only accept our order at the end of January because the shipments have already been scheduled until that time. The company also assured us that they had no problems at customs but warned that it would be better to transport goods through Poland and Latvia since the Lithuanian customs officers are more cautious.

Indeed, the Lithuanian customs were the first to notice a sharp increase in wood supplies from Central Asia. According to customs officials, Belarusian and Russian products are brought to customs with declarations stating that they have been purchased in Kazakhstan or Kyrgyzstan.

“The telltale signs are absolutely undeniable. We find markings on packaging, extra sets of documents that directly show that the goods come from Russia or Belarus and not from the countries in which the declaration was made at the initial stage. There are such cases, we recorded it, and not just one”, said Vygantas Paigozinas, the deputy director of Lithuania’s customs.

When the BIC journalists turned to Agro KG and Admit for an official comment, the companies began to deny that they were bringing banned Belarusian products to the EU under sham papers. The co-founder of the SK Grand company said that she didn’t know about the supplies in circumvention of the sanctions and promised to look into it. We are awaiting her response.

The Vivalsa company may be involved in the trade in contraband products in Lithuania, as our colleagues from the Siena Investigation Center found out. Previously, this company sold pellets from Russia, but after the imposition of sanctions, the company began to supply Kyrgyz and Kazakh products. Siena’s journalists came to the company's warehouse under the guise of customers and found Agro KG products there. Saulius Girčys, director and co-owner of Vivalsa, admitted that these pellets are from Belarus.

Girčys is a Lithuanian politician. He participated in local elections from the Social Democratic Party. In an official commentary for Siena, he stated that he only assumed that his company's goods came from Belarus. In the conversation, the businessman insisted that his company didn’t violate the sanctions.

Raimondas Kuodis, the deputy chairman of Lithuania’s central bank, says that Russian and Belarusian companies will continue to bypass the sanctions while Western democracies remain reluctant to punish the countries that facilitate the trade.

Kuodis, who is also a renowned economist, called for countries like Kazakhstan and Kyrgyzstan that help Russia and Belarus to evade sanctions to face the same penalties themselves.

“Their exports would be facing significant tolls, and that threat alone would force them to the good side. Then, the impact on the aggressor [Russia] would be shattering”, Kuodis said.

Authors: Olga Ratmirova, Kseniya Viaznikoutsava, Alexander Yarashevich. Editor Aliaksei Hulitski